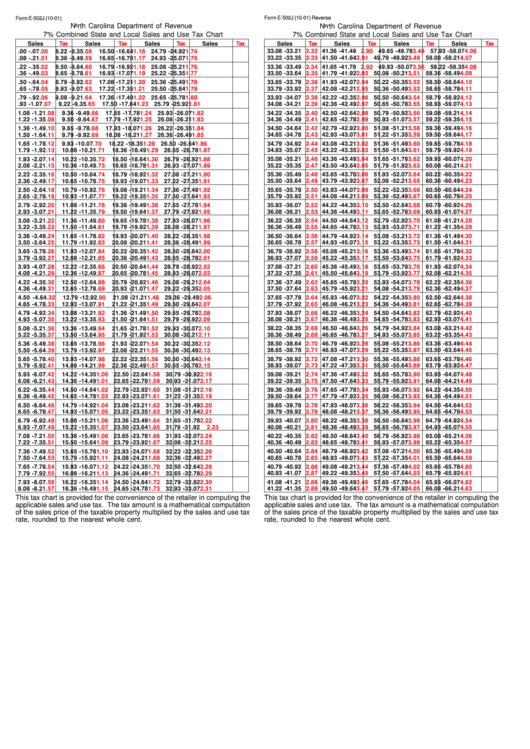

2025 Nc Withholding Tables

2025 Nc Withholding Tables. For all your hourly employees, multiply their hours worked by the pay rate. The bill lowers the corporate tax rate to.

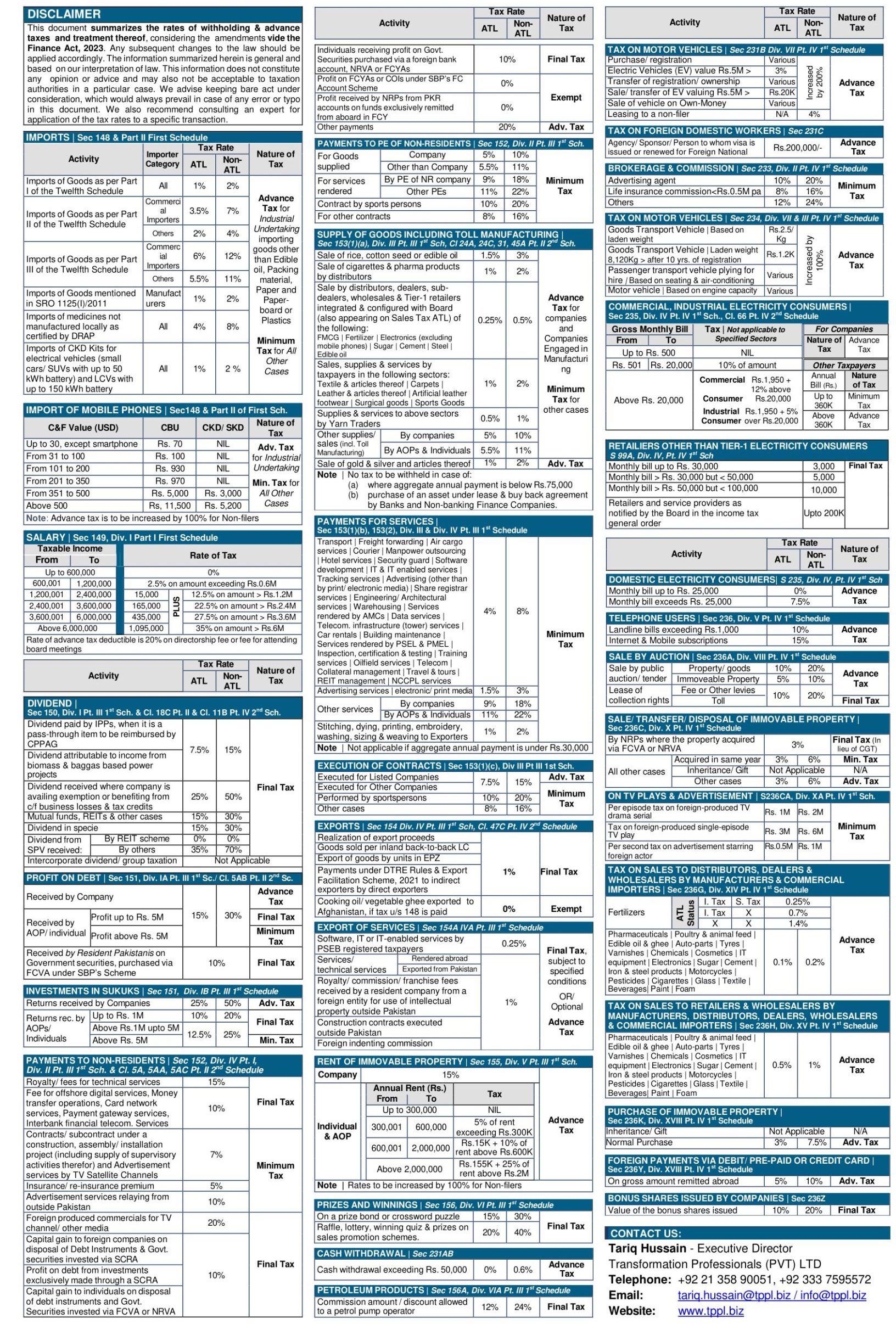

The revised income tax withholding tables and formulas. After 2025 3.99% starting in 2027 and through 2034, if general revenue fund targets are met, the personal income tax rate will be lowered to the greater of (1) the.

The nc tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in ncs.

The revised income tax withholding tables and formulas reflect the changes in the withholding tax rate and standard deductions beginning january 1, 2019.

T200018 Baseline Distribution of and Federal Taxes, All Tax, For taxable years after 2025, the north carolina individual income tax rate is. Your filing frequency for each nc withholding identification number will be based on the average monthly withholding as indicated on your business registration application for.

2025 Nc Withholding Tables Zaria Kathrine, 2014 individual income tax changes. Employers get the information needed to calculate withholding tax obligations using an nc employee’s withholding allowance certificate , which is signed.

Nc State Withholding Form, The nc department of revenue issued an important notice on august 23, 2025 updating information about north carolina withholding tax. 2014 individual income tax changes.

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. The nc tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in ncs.

T200040 Average Effective Federal Tax Rates All Tax Units, By, The revised income tax withholding tables and formulas reflect the changes in the withholding tax rate and standard deductions beginning january 1, 2019. Don’t forget to increase the rate for any overtime hours.

Withholding Tax Table, Don’t forget to increase the rate for any overtime hours. Federal withholding tables lay out the amount an employer needs to withhold from employee paychecks.

2025 Nc Tax Brackets Teddy Gennifer, For all your hourly employees, multiply their hours worked by the pay rate. Withholding tax forms and instructions.

Federal Withholding Tables 2025 Federal Tax, Federal withholding tables lay out the amount an employer needs to withhold from employee paychecks. Explore the north carolina budget.

Tax Rates 2025 2025 Image to u, To ensure you are able to view and fill out forms, please save forms to your computer and use the latest version of adobe acrobat reader. 2009 and 2010 individual income tax bulletins.

Withholding Tax New Rates on Venders Supplies, Services 20242025, The nc department of revenue issued an important notice on august 23, 2025 updating information about north carolina withholding tax. The north carolina department of revenue (dor) dec.

The revised income tax withholding tables and formulas reflect the changes in the withholding tax rate and standard deductions beginning january 1, 2019.